How False Claims Act penalties are determined is a complex process and, depending on the specifics of each case, can result in anywhere from tens of thousands to millions of dollars in penalties. We explain the reasoning behind how these penalties are calculated, what might constitute a violation of the federal False Claims Act in healthcare, and provide a brief explanation of how the FCA works.

Are you facing False Claims Act penalties? The healthcare fraud attorneys at Sellers Law Firm provide our clients with aggressive, thorough, and trial-tested defense against False Claims Act claims. Call us today to set up your free consultation: 817-928-4222.

False Claims Act overview

The False Claims Act is a type of whistleblower law — a law that rewards those who expose types of fraud that results in a financial loss to the federal government. There are many types of violations of the FCA, ranging from construction issues on government projects (such as state highways) to educational grant scams. However, the most common types of False Claims Act violations occur within the healthcare industry, especially with regard to Medicare and Medicaid.

What is the penalty for violating the False Claims Act?

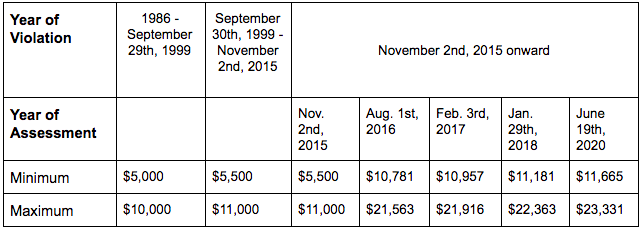

Each individual violation of the False Claims ACT may constitute a claim, meaning every violation of the False Claims Act — each unlawful contract, bill, or request — can incur a penalty. The minimum and maximum amount of civil penalties for False Claims Act violations also depends on the date of the violation and the date of the assessment.

Note under the False Claims Act individuals and businesses may be liable for a civil penalty as well as treble damages (triple the damages).

Examples of a violation of the False Claims Act in healthcare

Most False Claims Act cases in healthcare deal with fraud of Medicare and Medicaid as well as health insurance both government sponsored programs. The top types of False Claims Act claims that we see include:

- Bundling and unbundling: Charging separately and in excess for procedures and lab tests that are typically performed and charged for together.

- False certification: Submitting certifications to the government that state services are being performed in accordance to all obligations and regulations when they are, in fact, not being performed correctly.

- Ghost patients: The submission of claims for treatment for patients who did not exist (or who never received the services billed for).

- Kickbacks: It is illegal to receive referral fees, finder’s fees, grants, discounts, etc. as a reward for referring patients to a certain institution or physician.

- Lack of medical necessity: Submitting claims for services and treatments that the patients never needed in the first place.

- Services not rendered: Charging for services that were never rendered in the first place.

- Upcoding: Both the government and insurance programs use numerical codes to identify certain procedures. Upcoding occurs when a claim with a more expensive code is used instead of the procedure that was actually performed.

What should I do if I’m facing False Claims Act Penalties?

If a whistleblower has reported your company for violation of the False Claims Act in error, you may be facing severe False Claims Act penalties. The federal fraud defense lawyers at Sellers Law Firm have decades of experience defending our clients from charges of white collar crime.

At Sellers Law Firm, we recognize that what’s at stake when these claims have been leveraged is more than just finances, but also the reputation of your practice or company. You can depend on us to build a strong case in your defense and protect your good name from these allegations.

You only get one shot at this; work with the trial-tested professionals at Sellers Law Firm. Contact us online or give us a call at 817-928-4222 today to get started.

More Helpful Articles by Sellers Law Firm